Return to Work vs. Return to Function – Insurers Part 4

In Part 3 of this series, dated 9/28/2018, I discussed the “What’s in It for the Caregiver/Provider” regarding RTW. Today I will discuss the common perceptions, misconceptions and the “What’s in it for the Insurers”, the results of my interviews with a variety of insurers and TPAs regarding RTW, and a best practice statement by the IAIABC. Please refer to my post dated 9/26/2018, for the list of all stakeholders we identified.

Insurers

During our IAIABC project we discussed the perception about insurers; we believed the perception out ‘there’ is that they care about profitability at the expense of the well-being of injured worker – that they just want to grow their share of gold coins. There is also the perception that the closure of claims is more important than return to work or function. I surveyed the attendees at the recent NAOHP conference, and these exact two perceptions were reiterated.

Reality of Why Insurers Should Care About Return to Work?

Return to work results in shorter claim duration leading to:

- Decreased claims professional loads (which can be incredibly high in some cases – in some cases, hundreds of files per adjuster).

- Facilitation of timely and medically appropriate care for each injured worker

- Decreased indemnity payments and improved loss ratios

- Decreased risk of litigation as the insurer can handle their decreased caseload with more care and attention

By promoting return to work and positive relationships with the injured, an insurer can return a worker to a greater level of function and earning capacity, which reduces the value of the claim and possible settlement amount.

Interviews with Insurers and TPAs

This was the section that I researched for our paper on RTW. The following questions were asked of each company I interviewed. I will include highlights from the responses given. My takeaway from the interviews were that each company truly cared about RTW, some of the companies were further along in developing processes that helped to maximize this goal, and communication between all stakeholders inside and outside of the Insurer or TPA company is essential.

Interview Questions

- Main Goal of Your Company’s Claims Management Processes? “Provide the best medical care to the IW as quickly as possible and RTW as soon as it is safe.” “RTW as they act as representative for the employer. How might this experience the experience mod? How to keep in Med Only vs Lost Time. Bringing claim to closure – which means medical closure, RTW, how to reduce the exposure perhaps by using Voc Rehab, Settlement. Customize the program to the needs of their client.” “To reduce costs for the stakeholder, we don’t follow the typical claims model, we utilize data claims outcomes. Partnership between policy holder and our company.” “Help the IW thru the process to return to function as safely and quickly as possible. We are the advocate that helps the IW through the process.” “Focus on customer experience, make sure the customer is armed with all information needed. Encourage timely reporting, to keep in compliance with state rules, etc. The sooner the claim is reported we can facilitate RTW and medical care.”

- Adjuster Training – Timeframe, what is stressed? Training varied depending on level of expertise, if the adjuster was Med Only or Lost Time. Training provided on how to approach the employer, obtain Job Descriptions, Transitional Work Options, and Points of Contact. Training is ongoing – never stops, and also focuses on how to speak with the Injured Worker. One company stated this year their training was focused on holistic case management, need for duration management usage, clinical resources and including empathic training refresh. One company keeps the caseloads down to 75 files and focuses their adjusters on specific jurisdictions.

- What are the Best Practices your company employs or that you encourage for your employer clients? Most companies utilized the ODG or ACOEM for estimates of disability, appropriate care, etc. Some companies were also incorporating information on co-morbidities, standards on pathways to RTW or ADA consideration.

- Job Analysis – How do you use? During Rehab phase? One company stated they require specificity of the functional requirements, helps to explore accommodations. Can be used for causation determination also. Many of the companies interviewed are just beginning to see the need to obtain Job Descriptions, Analysis and Job Banks. This is an area of focus that overall could use more emphasis on the part of Insurers, TPAs and employers.

- Transitional or Modified Duty? How do you promote? One company is educating their clients to institute an integrated policy between the occupational and non-occupations absences at the place of employment. All supported some variation of reinforcement of ability to accommodate the Injured Worker in a modified duty position.

- Do you promote Alternative Transitional Duty? Does your jurisdiction have legal or policy barriers or concerns regarding alternative transitional duty? One company cited jurisdictional barriers may impact the ability to coordinate alternative transitional duty. Some companies are seeing increased interest in this service however others state their clients are not interested in this service.

- How or does Underwriting take the employers practices related to return to work into account? Do they provide any feedback, or engage Risk Management or Loss Prevention team? A recurring theme with the companies I interviewed was the claims staff communicated information to the underwriters but were unsure as to how this information was used. Only one company verbalized that they communicated regularly between the adjusters and underwriters, and that this communication regarding claim results, employer practices, etc. established the criteria for premiums.

- Do you have a RTW or Injury Prevention Programs that you use to train your employers? Do you develop these for your employer clients? Several of the companies stated they did not have employer training. One company stated they have handouts for smaller employers however they will go out and make presentations to their larger clients.

- How does the Sales Team promote RTW concepts to your prospective clients? There was little consensus regarding the Sales Team promoting RTW concepts with prospective clients. One company stated their Sales Team did promote RTW during initial sales meetings.

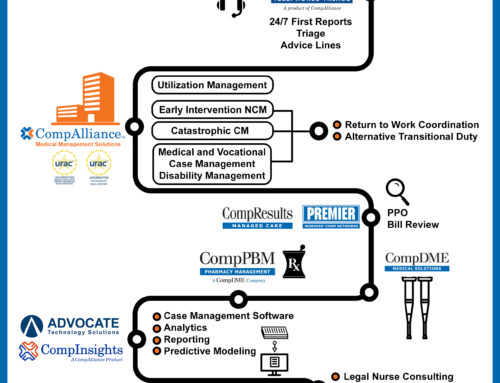

- Do you have Case Management involvement? 24/7 Triage – Nurse Triage is becoming a larger component of initial Case Management care at many of the companies. In some cases, this is defined as more like a traditional TCM program. Telephonic – Most of the companies utilize TCM as their first level of Case Management, many have in-house TCM. Field – Many of the companies stated they are transitioning over to a more task-based case management if a field visit is required.

- Do you have educational content, whitepapers, etc. that you use to educate your clients? Some companies rely on their social media accounts to educate their clients. Only one company stated they have an online resource library for their clients.

- What type of communication do you promote with the treating physician? One company stated they have developed a network of physicians and evaluate their care/outcomes and have established a 5-star rating system. The adjusters update the ratings as care is provided to the injured worker with a goal of improving the quality of the network and to narrow the network appropriately. One company stated they focus on RTW coordination and information with the physician from day one.

- Do you have any data or measures that demonstrate the value of certain approaches or best practices? The data was collected typically in the claims management systems. Some companies stated they were just beginning to use this information to develop data analytics, some companies were not quite there yet. One company was very sophisticated in their use of data analytics.

What works?

In talking with an injured worker, claims professionals must reinforce the message that return to work is important for both physical and psychological healing. The development of an individualized return to work plan in consultation with the injured worker and employer is key.

Involving the injured worker’s family in the development of the plan ensures clear understanding by the family members and solidifies support from the family in the injured worker’s return to work.

Promoting return to work with the employer is also important for claims professionals. The adjuster may need to work with an employer to overcome resistance to return to work and determine the availability of modified work. Claims professionals are critical in supporting return to work. Their connection with the injured worker, employer, and caregivers gives them significant influence. Insurers are wise to invest in developing their claims practices around this goal. It is equally important to monitor the success of programs to ensure they are effective.

In Summary

Promote RTW to improve outcomes and reduce disability costs. Opportunities for promoting RTW exist across an insurer’s entire operations, including underwriting, risk management, loss prevention, sales and marketing, and claims management. Identify and address barriers to RTW early in the claim – start from Day 1! Take steps to instill a RTW culture across your claim stakeholders, policyholders, and customers. Don’t be afraid to use vocational professionals. Their services should be viewed as an investment, not a cost.

Returning injured workers to productive employment has a positive impact in many ways – not just to the bottom line, but employer policyholders who understand the value of a robust return to work program are easier to do business with. When an employer has a return to work program in place, the insurer’s claim professional becomes an ally and adds value by partnering with the insured, injured worker and caregivers to facilitate return to function.